China’s Property Junk-Bond Sector Is an Unlikely Gem

Despite China’s fragile housing sector, Chinese property developers’ U.S. dollar bonds are top performers so far this year.

By Fiona Law

Nov. 1, 2015 10:47 p.m. ET

Chinese home builders’ U.S.-dollar bonds have become an unlikely winner among global assets this year.

From China’s feeble housing market to a high-profile developer default and the industry’s growing debt pile, the deck seemed stacked against the home-building sector late last year and into early 2015.

But a few factors have brightened prospects for dollar debt issued by Chinese developers. First, China’s yearlong monetary-easing campaign has sent a wave of cash into the market. That coincided with lighter restrictions on home builders’ ability to raise debt onshore and new government measures to support home buying.

More recently, the early summer selloff in China’s stock market and its currency devaluation in August pointed investors to the perceived safety of bonds denominated in dollars.

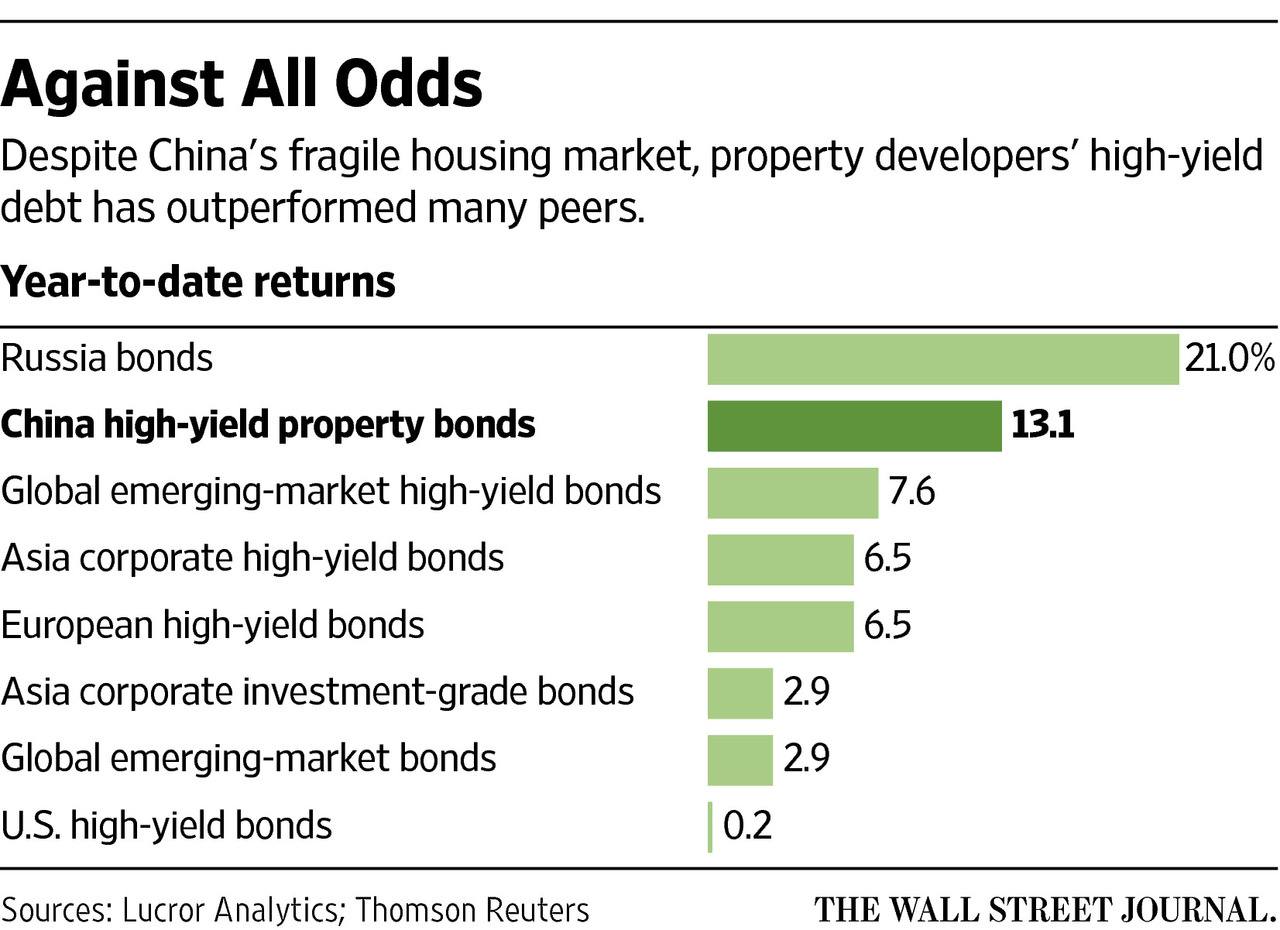

Bonds from Chinese property developers with below-investment-grade credit ratings have produced a 13.1% return in dollar terms to date this year, according to credit-research firm Lucror Analytics. That outpaced returns of 7.6% for global emerging-market high-yield bonds and 0.2% for U.S. high-yield debt.

These bonds have beaten equities. Chinese stocks are up 2.8% this year, while the Dow Jones Industrial Average has lost its gains for the year.

“It’s probably a surprise to investors and observers from outside Asia…given what we know about China’s economic slowdown, the collapse of the equity markets in June to July, and the depreciation of the currency,” said Ashley Perrot, head of pan-Asia fixed income at UBS Global Asset Management.

The performance marks a turnaround from a bond selloff earlier this year, when the first major default of a home builder, Kaisa Group Holdings Ltd., slammed the $38 billion market for high-yield Chinese property debt.

That added to pressure from tumbling oil prices and uncertainty about the timing of a U.S. rate increase, which also spurred selling among other high-yield bonds in the region.

Yet the tumult may have clouded some of the steps Chinese officials have taken that are now supporting the strong performance of high-yield property bonds.

In January, authorities allowed unlisted developers to raise debt onshore. The surge in demand that followed enabled developers to sell that debt at a lower cost than their offshore borrowings.

In June, Evergrande Real Estate Group Ltd. , one of China’s largest property developers, sold 5 billion yuan ($792 million) worth of bonds in the local debt market at a 5.4% yield—much lower than the prevailing 12.1% yield on its offshore dollar bonds.

Until this year, restrictions designed to cool red-hot housing prices limited developers’ ability to raise cash in the domestic market and pushed firms to seek financing offshore. Those firms had become some of the biggest sellers of U.S. dollar debt in Asia, accounting for 38% of the region’s $100.57 billion high-yield debt market.

Since June, 337 billion yuan worth of domestic debt has been raised by home builders in China.

Lower onshore yields have deterred firms from issuing expensive debt in the overseas market and prompted repayment of their more expensive U.S. dollar borrowings earlier than scheduled.

A weaker yuan, which has fallen 1.8% since the devaluation, balloons foreign-debt burdens and gives firms incentive to trim their offshore debt exposure.

Alfred Mui, who helps run the $619 million Asia high-yield bond fund at HSBC Global Asset Management, has been adding exposure to bonds issued by developers that are likely to issue bonds at home.

“Those carrying higher yields have bigger motivation to do so,” he said.

Buybacks have also trimmed the supply available to international investors, who have limited access to China’s domestic capital market, sending prices higher. In September and October, home builders Gemdale Corp. and Soho China Ltd. announced plans to repurchase a combined $750 million worth of U.S. dollar bonds.

One reason Chinese property bonds have done so well lately is because they had such a shaky start to the year.

Jitters about Kaisa’s inability to repay its debt started to spread in December, when the local government blocked its property-unit sales, though the firm officially defaulted in April. The home builder’s dollar bonds were widely held by global money managers.

The sector was “under a huge amount of stress very early in the year and credit spreads were very wide,” said Mr. Perrott at UBS, referring to the difference in yields of Asian junk bonds with virtually risk-free U.S. Treasurys.

“Concerns back then centered on whether Kaisa’s problems were just the tip of the iceberg,” he said. But “as time went by…anxieties subsequently died down.”

Excluding a short period during the summer’s stock selloff, the sector has stabilized and yields have returned to levels reached before Kaisa’s default.

In a sign of Kaisa’s brightening outlook, a senior adviser to the company said on Friday that the firm’s talks with bondholders about its debt restructuring proposals were making “good progress.” Tam Lai Ling, a former vice chairman, didn’t elaborate and said the discussions were confidential.

Meanwhile, Standard & Poor’s Ratings Services revised its outlook on a major developer, Longfor Properties Co. , meaning it might upgrade the firm’s credit rating in the near future.

While China’s housing prices have been showing signs of improvement, the market isn’t out of the woods, as investment in real-estate development remains sluggish. Some bond yields are at their lowest levels on record, casting doubt on the sustainability of any rally.